Documents Required for Land Registration in Tamil Nadu

April 25th, 2025

Land registration is not just a legal formality, it is the foundation of your property ownership. In Tamil Nadu, having the right documents in place ensures a smooth, hassle-free registration process and protects your rights for generations to come.

Buying land in Tamil Nadu is a significant investment, and registering it legally is important to protect your ownership rights. The process of land registration in Tamil Nadu may seem administrative, but it is a vital legal procedure that validates your claim and ensures future security.

From verifying the title to paying stamp duty, each step is governed by strong regulations designed to promote transparency. Tamil Nadu Registration Department, Sub-registrar’s Office, and legal advisors play distinct roles in streamlining the transaction. Equally important is your awareness of the mandatory documents required for land registration – such as Patta, Chitta, Encumbrance Certificate, tax receipts, and layout plans.

In order to further strengthens the process, understand the applicable stamp duty and registration charges Tamil Nadu and opt for legal support in complex cases. This blog walks you through everything you need to know – offering insights and actionable tips to help you navigate the Tamil Nadu land registration process efficiently and with complete peace of mind.

Table of Contents

Importance of Land Registration in Tamil Nadu

Tamil Nadu land registration process is essential for establishing legal ownership and safeguarding property rights. The process involves verifying property details, creating the sale deed, payment of stamp duty and registration charges Tamil Nadu, and registering the property at the Sub-registrar’s Office within 4 months of executing the sale deed. Delays can incur penalties ranging from 25% to 100% of the registration fee, depending on the duration of the delay.

Proper registration has significant legal implications. It provides indisputable proof of ownership, which is important for resolving disputes, securing loans, and transferring property. An unregistered property may lead to legal complications, including challenges to ownership and difficulties in selling it. Therefore, completing the Tamil Nadu land registration process promptly ensures legal security and peace of mind for property owners.

Key Authorities Involved in Land Registration

To safeguard the interests of all stakeholders, these authorities together ensure that Tamil Nadu land registration process is conducted transparently, legally, and efficiently.

- The process is overseen by the Tamil Nadu registration department, a division of the Department of Commercial Taxes and Registration. It manages these key transactions, ensures legal compliance, and maintains public records.

- Sub-registrar’s Office plays a pivotal role in this process. Each Sub-registrar, appointed under Section 6 of the Registration Act, 1908, is responsible for registering property documents within their jurisdiction. Their duties include verifying the authenticity of documents, collecting stamp duty and registration fees, and maintaining records of all registered transactions.

- Legal advisors are instrumental in ensuring the legality of property transactions. They assist in drafting sale deeds, verifying ownership documents, and conducting due diligence to prevent future disputes.

- Survey officials, under the Commissionerate of Survey and Settlement, are tasked with verifying land boundaries and measurements – ensuring accurate records and preventing encroachments.

15 Documents Required for Land Registration in Tamil Nadu in 2025

Registering land in the state is a legal necessity that ensures rightful ownership and transfer of property. The process mandates the submission of specific documents to the Sub-registrar’s Office, facilitating transparency and legal compliance in property transactions. Here is a comprehensive overview of the documents required for land registration:

-

Identity & Address Proof of Buyer & Seller

Both parties must furnish valid identification and address proofs. Acceptable documents include Aadhaar cards, PAN cards, passports, or driving licences. These are essential for verifying the identities and addresses of the individuals involved in the transaction.

-

Parent Deed (Previous Sale Deed, Gift Deed, or Partition Deed)

This serves as the primary legal document establishing the property’s ownership history. It could be a previous sale deed, gift deed, or partition deed – detailing the chain of ownership and confirming the seller’s right to transfer the property.

-

Patta, Chitta, and Adangal

These are land revenue records issued by the state government. Patta indicates the legal owner of the land, Chitta provides details about the land’s classification and area, and Adangal records the land’s usage and cultivation details.

-

Encumbrance Certificate

EC is an important document that certifies the property does not have any monetary or legal liabilities. It provides a record of all registered transactions related to the property, ensuring there are no existing encumbrances.

-

Latest Property Tax Receipts

These confirm that all property taxes have been duly paid up to date. They serve as proof of the seller’s compliance with municipal tax obligations, which is critical for smooth transfer of ownership.

-

Sale Agreement

This contains the conditions agreed by sellers and buyers, prior to the execution of the final sale deed. Terms that are a part of this document are sale price, payment terms, and other relevant clauses – ensuring clarity and mutual consent.

-

Survey and Settlement Documents

These provide detailed information about the property’s boundaries and measurements. They are essential for verifying the exact extent and location of the land, preventing future disputes related to property lines.

-

Approved Layout or Plot Plan

For properties in plotted developments, an approved layout or plot plan sanctioned by the relevant planning authority is required. This ensures that the development complies with municipal zoning and planning regulations.

-

No Objection Certificate from Relevant Authorities (if required)

NOC may be necessary from various authorities, such as municipal corporation or housing society, confirming that there are no objections to the property’s sale. This is particularly important if the property has specific restrictions or obligations.

-

Stamp Duty and Registration Fee Payment Receipt

This serves as proof of payment for stamp duty and registration charges Tamil Nadu, which are mandatory charges levied by the government during property registration. It is a crucial document for the legal validation of the transaction.

-

TDS Certificate (for properties valued above ₹50 lakh)

For property transactions exceeding ₹50 lakh, buyers needs to deduct 1% TDS (tax deducted at source) and provide TDS certificate that confirms the tax has been duly deducted and deposited with the government.

-

Power of Attorney (if applicable)

If the buyer or seller is unable to be present during the registration process, POA document authorising another individual to act on their behalf is necessary. The POA must be duly executed and registered.

-

Legal Heir Certificate (for inherited properties)

In cases where the property is inherited, a legal heir certificate is required to establish the rightful successors. This document is essential for transferring the property title to the legal heirs.

-

Court Orders (if any disputes are involved)

If there have been legal disputes concerning the property, relevant court orders resolving these issues must be presented. These orders provide legal clarity, and are necessary for the Tamil Nadu land registration process.

-

NRI Documents (if the buyer or seller is an NRI)

For Non-resident Indian buyers or sellers, additional documents such as valid passport, visa, and proof of residence abroad are required. If a representative is acting on their behalf, a duly executed and registered POA is also necessary.

These documents are important for smooth land registration in Tamil Nadu, as they facilitate legal compliance and consider the requirements of buyers, sellers, and the government.

Key Steps in Tamil Nadu Land Registration Process

Registering land in the state involves a streamlined legal process, that is designed to ensure transparency and protect ownership rights. It begins with the verification of documents, where the buyer and seller must gather and cross-check essential records such as parent deed, Patta, Chitta, Encumbrance Certificate, tax receipts, and identity proofs. Legal advisors may be involved at this stage, to confirm the authenticity of documents.

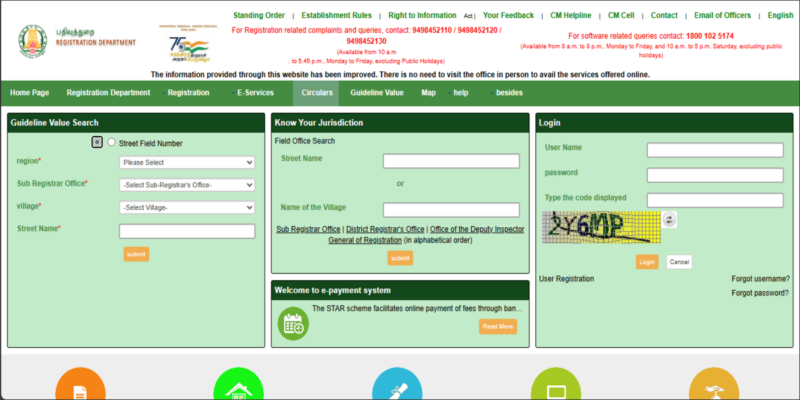

Once verified, the payment of stamp duty and registration charges Tamil Nadu is made – either online through the TNREGINET portal, or offline via authorised banks. The amounts are computed basis the market value or guideline value of the property, whichever is higher.

After payment, documents required for land registration are submitted at the Sub-registrar’s Office. Both parties must be physically present with the original documents, payment receipts, and ID proofs. The next step includes signing and biometric verification – where photographs, thumb impressions, and digital signatures are recorded in the government database to validate the transaction.

Finally, the authorities complete verification and issue the registered sale deed, which serves as legal proof of ownership. This document can be collected in person or downloaded from the online portal. Completing each step diligently ensures legal protection and valid property title.

Fees and Charges for TN Registration

In Tamil Nadu, land registration involves mandatory fees that contribute to the overall cost of property transactions.

- Stamp Duty: This is a state-imposed tax on property transfers, calculated at 7% of the property’s market value or the guideline value, whichever is higher. This fee is essential for the legal validation of the transaction.

- Registration Fees: Charged at 4% of the property’s value, this fee covers the cost of officially recording the property in the government’s records. It ensures the buyer’s legal ownership is documented and recognised.

- Document Writing Charges: These are fees paid to licensed document writers who prepare the necessary legal documents for the transaction. Charges vary based on the complexity and value of the property.

It is important to note that stamp duty and registration charges Tamil Nadu are standard, and apply uniformly across the state – ensuring transparency and consistency in property transactions.

Important Tips for Hassle-Free Land Registration in Tamil Nadu

For a hassle-free experience, start by ensuring all documents are legally verified. Cross-check title deeds, Patta, Chitta, tax receipts, and layout approvals with the concerned authorities to avoid discrepancies. Check for encumbrances before purchase, by obtaining the latest EC from the Sub-registrar’s Office, to confirm that the land is free from legal or financial liabilities.

In complex transactions involving inheritance, power of attorney, or court orders, it is advisable to consult a legal expert. A lawyer specialising in real estate transactions can oversee the legal due diligence process, reducing the risk of future disputes.

Once the sale deed is registered, keep multiple copies of all registered documents – both physical and digital. Store them securely, as these serve as legal proof of ownership. Following these steps ensures that your land registration in Tamil Nadu is smooth, transparent, and legally compliant.

Also Read: All You Need to Know About TNREGINET Portal, Tamil Nadu

Conclusion

Completing the Tamil Nadu land registration process is not just a procedural formality, it is a safeguard for your most valuable asset. Accurate and verified documentation forms the backbone of secure property transactions.

Whether it is verifying encumbrances, ensuring updated revenue records like Patta and Chitta, or paying the correct stamp duty and registration charges Tamil Nadu, each step plays a legal role in affirming your ownership. Inheritance transfers, power of attorney transactions, and purchases by NRIs demand even more diligence – often requiring expert legal guidance. Maintaining multiple copies of your registered documents also protects you in the long term.

By adhering to the official processes and consulting professionals when necessary, you can avoid future disputes, delays, or costly litigation. Thorough documentation and legal compliance are not just recommended; they are essential. When done right, land registration in Tamil Nadu offers clarity, security, and peace of mind – allowing you to invest with confidence and build your future on a foundation that is legally sound.

FAQs

1. Which are the documents required for land registration in Tamil Nadu?

Documents required for land registration are identity & address proofs, sale deed, parent deed, Patta, Chitta, Encumbrance Certificate, tax receipts, layout plan (if applicable), payment receipts, and sale agreement. Additional documents include Power of Attorney, legal heir certificate, or NOC depending on the nature of the transaction.

2. How can I verify the ownership and legal status of land before purchase?

You can verify the ownership and legal status of land before purchase, by checking the parent deed, obtaining the latest Encumbrance Certificate, verifying Patta and Chitta records, and ensuring the seller has paid property taxes. A legal expert can help you in assessing document authenticity and confirming the property's freehold status and boundary accuracy through survey documents.

3. What is Encumbrance Certificate (EC), and why is it necessary?

Encumbrance Certificate lists all registered transactions on a property, confirming it is free from legal or financial liabilities. It is necessary for property verification, securing home loans, and ensuring clean title transfer during land registration in Tamil Nadu.

4. What are the land registration stamp duty and registration charges Tamil Nadu?

Land registration stamp duty and registration charges Tamil Nadu are 7% and 4% respectively – of the property’s market or guideline value, whichever is higher. Additional charges may apply for document preparation and legal assistance. These fees must be paid before submitting documents to the Sub-registrar’s Office.

5. Is it mandatory to have Patta and Chitta for land registration?

Patta and Chitta are required for verifying land ownership, classification, and revenue status. While not mandatory for registration of built-up properties, they are essential for vacant land registration, mutation, and long-term legal compliance in Tamil Nadu.

6. Can land be registered under Power of Attorney?

Yes, land can be registered under Power of Attorney, provided it is duly stamped, registered, and grants clear authority. This facility is used by NRIs, senior citizens, or individuals unable to visit the Sub-registrar’s Office in person.

7. What is the process for registering inherited land?

The process for registering inherited land begins with obtaining Legal Heir Certificate and updating the land revenue records (Patta mutation). Once legal ownership is established, the land can be registered in the heir’s name through a succession deed or court order, depending on the inheritance scenario.

8. Can NRIs buy and register land in Tamil Nadu? What additional documents are required?

Yes, NRIs can buy and register non-agricultural land in Tamil Nadu. Additional documents that are required include passport, visa, residence proof, PAN, and registered Power of Attorney if someone represents them. KYC and TDS compliance are also mandatory for transactions above ₹50 lakh.

9. How long does it take to complete the land registration process?

It takes 1-2 working days to complete the land registration process, once documents are verified and stamp duty and registration charges Tamil Nadu are paid. However, preparing documents, legal checks, and obtaining clearances may take a few weeks – depending on property type and transaction complexity.

10. Where can I check the land registration details online in Tamil Nadu?

You can access land registration details through the Tamil Nadu Registration Department’s portal at https://tnreginet.gov.in which provides access to ECs, guideline values, registered document details, and Patta / Chitta status – after entering survey numbers or document numbers.