BENGALURU

The Silicon Valley of India, Bangalore is home to pleasant climate and seamless connectivity. An ever-booming real estate skyline, Bengaluru is our home ground, featuring some of the finest luxury flats strategically spread across the city. SOBHA is known for its Architectural Theme based Apartment Projects in Bangalore.

SOBHA Offers Best Flats in Bangalore for Sale, Luxury Apartments & Houses in Bangalore.

58 Row Houses Available

58 Row Houses Available

SOBHA OAKSHIRE

Picturesque Tudor Homes

Off Bellary Road, Devanahalli, Bengaluru | 3441 to 3467 sq. ft. | 4 BHK Row Houses

137 Apartments Available

137 Apartments Available

SOBHA DREAM GARDENS

Zen Themed Apartments

Off Thanisandra Main Road, Bengaluru | 1004 Sq.ft. - 1058 Sq.ft. | 2 BHK

Sold Out

Sold Out

SOBHA VICTORIA PARK – APARTMENTS

Victorian Era - Themed Luxury Residences

Off Hennur Main Road, Bengaluru | 1419 to 1833 Sq. Ft. | 2 & 3 BHK Apartments

Sold Out

Sold Out

SOBHA ATHENA

Super Luxury Apartments

Thanisandra Main Road, Bengaluru | 1682 to 1718 Sq. ft. | 3 BHK

2 Apartments Available

2 Apartments Available

SOBHA HRC PRISTINE

Luxury Apartments and Penthouses

Amruthahalli Main Road, Jakkur, Bengaluru | 1459 to 4112 Sq.ft. | 2, 3 & 4 BHK

Sold Out

Sold Out

SOBHA PALM COURT

Luxury Apartments

Kogilu Main Road, Yelahanka, Bengaluru | 1300 to 1900 Sq.ft. | 3 BHK

Sold Out

Sold Out

SOBHA LIFESTYLE LEGACY

Super Luxury Villas

IVC Road, Devanahalli, Bengaluru | 6100 to 7900 Sq.ft. | 3 & 4 BHK

Sold Out

Sold Out

SOBHA VICTORIA PARK – ROW HOUSES

Victorian Era - Themed Luxury Residences

Off Hennur Main Road, Bengaluru | 2646 to 2664 Sq. Ft. | 3 BHK Row houses

New Launch

New Launch

SOBHA CRYSTAL MEADOWS

Grand Quadruplex Row Houses

Off Sarjapur Road, Bengaluru | 4237 - 4815 Sq. ft. | 4 BHK

482 Apartments Available

482 Apartments Available

SOBHA NEOPOLIS

Greek-Themed Luxury Apartments

Panathur, Off Marathahalli-ORR, Bengaluru | 1611 to 2481 Sq.ft. | 3 & 4 BHK

25 Row Houses Available

25 Row Houses Available

SOBHA GALERA

Timeless Spanish Homes

Near Kannamangala, Bengaluru | 3009 to 4340 sq. ft. | 4 BHK Row Houses

13 Apartments Available

13 Apartments Available

SOBHA INSIGNIA

Bespoke Luxury Residences

Bhoganahalli, Bengaluru | 1819 to 3406 Sq. ft. | 3, 3.5 & 4 BHK

Sold Out

Sold Out

SOBHA SENTOSA

Singapore-themed Luxury Apartments

Panathur Main Road, Bengaluru | 1507 to 1804 Sq. ft. | 3 BHK

1 Apartments Available

1 Apartments Available

SOBHA WINDSOR

English Themed Luxury Apartments

Whitefield, Bengaluru | 1550 to 2292 Sq.ft. | 3 & 4 BHK

Sold Out

Sold Out

SOBHA DREAM ACRES

Aspiration Themed Apartments

Panathur, Off Marathalli Road, Bengaluru | 1007 Sq.ft. – 1020 Sq.ft. | 2 BHK

1 Apartments Available

1 Apartments Available

SOBHA LAKE GARDENS

Luxury Apartments

KR Puram, Bengaluru | 1358 to 1765 Sq.ft. | 2 & 3 BHK

Sold Out

Sold Out

SOBHA ROYAL PAVILION

Rajasthan Themed Luxury Apartments

Hadosiddapura, Sarjapur Road, Bengaluru | 1300 to 2232.2 Sq.ft. | 2, 3 & 4 BHK

25 Apartments Available

25 Apartments Available

SOBHA ROYAL CREST

Bangalore Palace-themed Abodes

Banashankari, Bengaluru | 1853 to 3448 Sq. Ft. | 3 & 4 BHK Luxury Apartments

Sold Out

Sold Out

SOBHA MANHATTAN TOWERS – TOWNPARK

New York Themed Luxury Apartments

Near Electronic City, Bengaluru | 1498 Sq. ft. | 3 BHK

64 Apartments Available

64 Apartments Available

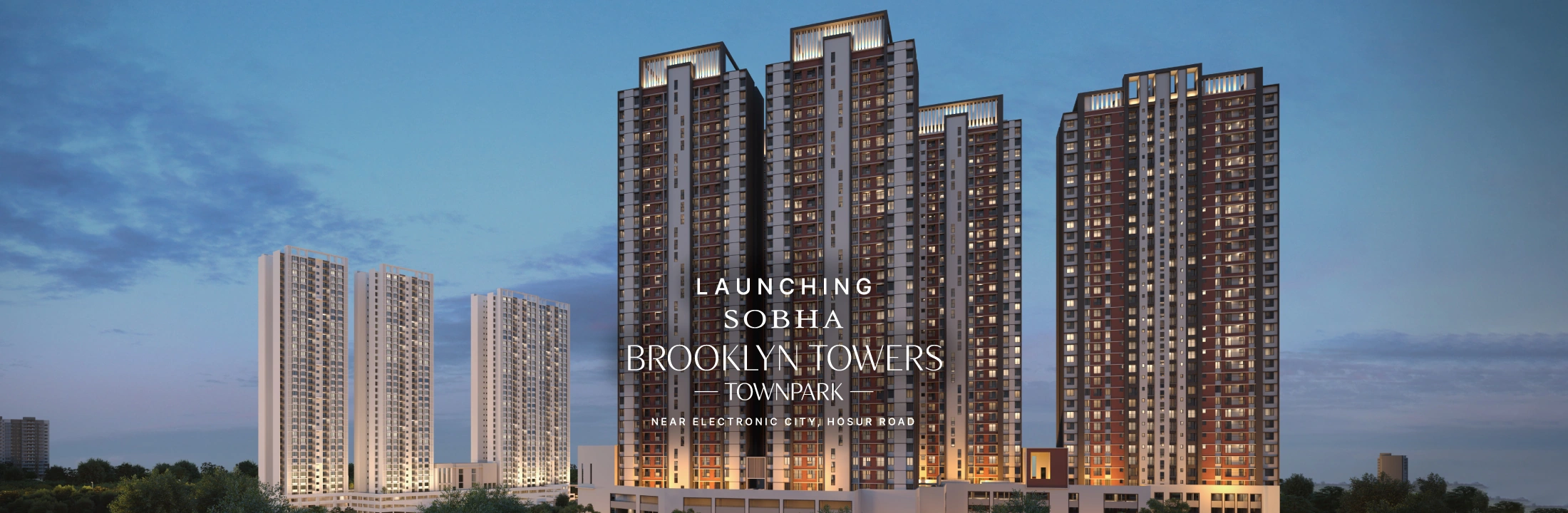

SOBHA BROOKLYN TOWERS – TOWNPARK

New York Themed Residences

Near Electronic City, Bengaluru | 1864 to 2402 Sq. Ft. | 3 & 4 BHK

29 Apartments Available

29 Apartments Available

SOBHA VALLEY VIEW

Ready to move-in Luxury Abodes

Banashankari, Bengaluru | 1304 to 1817 sq ft | 2 & 3 BHK

Sold Out

Sold Out

SOBHA ARENA

Sports Themed Luxury Apartments

Judicial Layout, Kanakapura Main Rd, Bengaluru | 1296 to 2040 Sq.ft. | 2 & 3 BHK

Sold Out

Sold Out

SOBHA CLOVELLY

Australian Boutique Themed Super Luxury Apartment

Padmanabhanagar, Bengaluru | 2051 to 4689 Sq.ft. | 3 & 4 BHK

Sold Out

Sold Out

SOBHA 25 RICHMOND

Super Luxury Apartments

Richmond Road, Bengaluru | 2700 to 3200 Sq.ft. | 3 BHK

RESOURCES

Why Bangalore is the Ideal City for Apartment Buyers?

Bangalore has emerged as a popular destination for real estate investment in recent years. The city is synonymous with a thriving startup ecosystem, multinational corporations, and a strong information technology hub. Moreover, Bangalore is a melting pot of diverse cultures, offering a rich history, vibrant lifestyle, and picturesque greenery. With a steady appreciation of real estate prices, competitive pricing, robust infrastructure, and ample leisure options, Bangalore has become the ideal city for apartment buyers. In this article, we will explore in detail why Bangalore is the perfect place to invest in an apartment.

Thriving Job Opportunities and IT Hubs in Bangalore

Bangalore is a leading IT hub that has attracted some of the best IT professionals from around the world. With the presence of companies like Google, Microsoft, Wipro, and Infosys there is never a dearth of IT jobs in the city.

Apart from IT companies, Bangalore is also home to a range of multinational corporations. Top companies such as Amazon, IBM, and Accenture have their offices here. That’s not all! The city boasts of a thriving start-up ecosystem, which is fuelling innovation and job creation.

Bangalore provides a creative and supportive environment for entrepreneurs to turn their innovative ideas into successful businesses. It also provides exceptional networking opportunities for startups, which could be a great starting point for new businesses. This is one of the main reasons why there are more people looking to buy apartments for sale in Bangalore.

Rapid Infrastructure Development of Bangalore City

Being one of the fastest-growing cities in India, Bangalore has witnessed a rapid transformation in its infrastructure development over the past few years. The city’s robust IT industry and global presence have significantly accelerated its growth trajectory.

Efforts to build 270 km of roads and around 127 km of metro are all at various stages of development in the city. The metro rail project has brought a significant change to the public transportation infrastructure in Bangalore, which has greatly reduced the traffic congestion in the city. The Bangalore Metro Rail Phase 2A between Silk Board Junction and KR Puram is under construction. This is expected to reduce travel time from Bellandur to KR Puram by 50 minutes.

The Metro Phase 2B project is a 17-station ‘airport-link’ segment of the Blue Line that is currently under construction. It runs from KR Puram to Kempegowda International Airport (KIA) in Devanahalli. Starting from Kempegowda International Airport, the route includes Devanahalli, Yelahanka, Hebbal, KR Puram, and further connects to Marathahalli, Bellandur, and Silk Board.

The construction of flyovers, underpasses, and widening of roads has dramatically transformed the city’s traffic management, making it more efficient. The upcoming Satellite Town Ring Road (STRR) is expected to benefit the industrial and logistics industries since it will simplify the distribution and delivery of goods to Karnataka’s interior. This six-lane corridor will pass through three districts in Karnataka (Bengaluru Rural, Bengaluru Urban, and Ramanagara), as well as one district in Tamil Nadu (Krishnagiri).

Another important development is the Peripheral Ring Road (PRR), whose growth would significantly affect the Yelahanka-Kogilu-Jakkur regions . This 8-lane, 74 km PRR will connect Tumakuru and Hosur roads through Hessaraghatta Road, Doddaballapur Road, Ballari Road, Hennur Road, Old Madras Road, Hoskote Road and Sarjapur Road.

Additionally, initiatives such as smart city projects and improvements to water supply systems have vastly improved living standards in many neighbourhoods. All these efforts towards infrastructural transformation have helped position Bangalore as an attractive destination for businesses and entrepreneurs looking to expand their enterprise in India.

Educational Institutions and Student Population

Bangalore has earned a well-deserved reputation as an educational hub with its world-renowned universities and institutions. The city boasts some of India’s best engineering colleges, the Indian Institute of Science (IISc), the Indian Institute of Technology (IIT) and the National Institute of Technology (NIT). The city is also home to prestigious management institutes such as the Indian Institute of Management Bangalore (IIMB). Additionally, there are several other specialized institutes in areas such as design and hospitality that attract students from across the country. Not only does Bangalore have exceptional academic programs for higher education, but it also has numerous quality schools for primary and secondary education, making it an ideal place to grow up for those focused on pursuing their academic interests.

With a rising population and robust economic growth, more people are moving to Bangalore for better educational facilities and employment opportunities. This influx of people has created a high demand for apartments, driving up real estate prices considerably.

Pleasant Climate and Cosmopolitan Lifestyle in Bangalore

Popularly called the ‘Garden City’, Bangalore is renowned for its pleasant climate. In fact, the city is located at a height of over 3,000 feet (914.m) above sea level, which is above Dehradun (630 m). This allows Bangalore to receive more rainfall and experience cooler temperatures, all year round.

With the presence of many global IT companies, the city has become a hub for skilled professionals from different parts of the world. Consequently, it has a cosmopolitan lifestyle with a diverse population of people from different ethnicities and cultures living together in harmony. This has led to the city becoming a melting pot of food, art, music, and culture, making it a fascinating place to live and explore. The blend of favourable weather, diverse culture, and exciting opportunities in Bangalore makes it an ideal place to live, study, and work.

Bangalore boasts of numerous apartments with large, open spaces and surrounded by lush greenery, making the perfect investment option for homebuyers.

Growing Demand for Residential Properties in Bangalore

The Silicon Valley of India has witnessed a surge in demand for residential properties, especially apartments in recent years. Bangalore’s growth as a hub for various industries, including IT/ITES, biotechnology, and aviation, has attracted professionals and entrepreneurs from different parts of the country and even abroad. Many IT companies have established their offices in the city, creating considerable demand for apartments. The city’s proximity to tech parks and the easy availability of other amenities such as schools, hospitals, and shopping centres is another incentive for many people to invest in residential properties, particularly apartments in Bangalore.

The locational advantage of Bangalore also plays a vital role in the rise in demand for apartments in the city. Bangalore is well-connected to other parts of the country via rail, road, and air. The presence of the International airport and the upcoming metro rail projects has significantly enhanced the connectivity of the city. This has made Bangalore an attractive destination for people looking to relocate in search of better job opportunities or a better standard of living.

Additionally, the city’s cosmopolitan culture, pleasant weather, and excellent education and healthcare facilities make it an ideal place to settle down. These factors have contributed to the rise in demand for apartments in Bangalore. The city’s real estate market has been experiencing a sustainable demand for affordable and premium apartments, making it a lucrative investment option for many homebuyers and investors. With the ongoing expansion of the city’s infrastructure and an ever-increasing demand for apartments, Bangalore’s real estate sector is expected to witness further growth in the coming years.

Bangalore’s population has been on the rise in the recent past. According to recent estimates, the city’s population stands at over 13 million people , and it’s expected to rise even further in the coming years. This consistent surge has led to a significant increase in demand for apartments and infrastructure development, leading to an appreciation of property value.

Availability of Luxury Apartments for Sale and Gated Communities in Bangalore

Given that Bangalore is known for its modern infrastructure and cosmopolitan lifestyle, it is no surprise that luxury apartments and gated communities are among the most sought-after residential options in the city. These exclusive properties come equipped with top-of-the-line amenities such as sports facilities, clubhouses, swimming pools, spas, and more.

The architecture of these properties showcases the latest design trends and caters to residents who seek a luxurious living experience. Gated communities offer a sense of safety and security, where residents feel comfortable letting their children play outdoors or go on walks alone. Additionally, they often boast of green areas like parks or landscaped gardens that provide a peaceful respite from the busy urban environment.

For those looking for top-notch accommodations in Bangalore, luxury apartments for sale and gated communities are definitely worth exploring.

One of SOBHA’s renowned projects, inspired by Spanish architecture is SOBHA Galera. These 4-bedroom duplex and triplex row houses are created to provide you with extraordinary luxury and unrivalled convenience.

SOBHA Townpark, near Electronic City, is another iconic project that is centred around the lifestyle of New York. Named after the boroughs of this mega city, SOBHA Townpark houses SOBHA Manhattan Towers and SOBHA Brooklyn Towers. Now, you can live life, the NYC style right in Bangalore.

An architectural homage to the traditional English way of life is SOBHA Oakshire. These four-bedroom row houses have gabled steep roofs, timber & brick construction, and elaborate windows. Tucked away in the peaceful locale of Devanahalli, these homes are crafted for the discerning few.

Investment Potential and ROI of Bangalore Flat Properties

Bangalore’s real estate market is developing, and there is a growing demand for both commercial and residential buildings, primarily apartments. The city provides better living conditions as well as greater career chances. Bangalore has made massive progress in terms of technology, transit, connection, upscale facilities, etc.

The professionals who relocate from various regions of Karnataka and India in a quest for better employment and a higher quality of life are the major source of the increasing demand for apartments for sale. Bangalore offers its residents a high quality of life by providing the greatest possible healthcare, education, and leisure opportunities.

The residential market in Bangalore offers both monthly rewards and capital growth. The rise in the number of young people moving to Bangalore for work or school tends to be the main driver of the city’s rental demand. The investor is guaranteed renters and a substantial monthly income in the form of rent by investing in quality apartments.

According to reports , there has been a dramatic increase in property values and rental yields in seven major cities over the past five years. Average property prices in Bengaluru and Hyderabad have increased by 10% during the last five years. According to data, the average price of a square foot of real estate in Bengaluru was Rs 4,894 in 2018 and rose to Rs 5,570 in 2022.

Supportive Policies and Regulations for Flat Buying/ Selling in Bangalore, Karnataka

The real estate industry was somewhat impacted by the pandemic epidemic. As workers moved back to their hometowns and prospective purchasers held off on purchases, the real estate market in all the major cities weakened. Construction on ongoing projects was also halted because of the lockdown.

The Karnataka government then revived the real estate industry. It was then decided that the stamp duty rate on houses costing between INR 35 and INR 45 lakhs will be reduced from 5% to 3%.

The Bruhat Bengaluru Mahanagara Palike (BBMP) has launched an e-Khata or e-Aasthi developed by the state’s e-governance department and NIC (National Informatics Centre). This would assist property buyers in uploading all property papers and their Aadhaar numbers online to apply for Khatas. Within a month, the digitally signed Khata certificates will be produced and distributed to property buyers.

How Can You Apply for an e-Khata?

An e-Khata application can be submitted in any of the following ways:

– You can manually apply for an e-Khata by going to a nearby Bangalore One centre.

Or by visiting the SAKALA website and entering your PID number, you can also submit an online application for e-Khata.

– Fill out the e-Khata application form online and include any supporting documents, such as a sale deed, an encumbrance certificate, an ID card, etc.

– The application will receive a SAKALA acknowledgement number after it has been processed. After which you’ll receive a digital signature. Finally, you may download the e-Khata.

In the event your application gets rejected, an officer will contact you and have you submit the documents once again.

Final Thoughts

Bangalore appears to be simply waiting for you if you’re in the pursuit of settling down in one of the most vibrant cities that boasts of a pleasant climate all year round. You may also discover a world of individual villas or beautifully themed apartments with numerous amenities and high-end facilities, amidst verdant surroundings.

Real estate developers have been encouraged by the multiracial population to invest in developments with characteristics designed to meet the ever-growing needs of homebuyers. The demand for residential developments has also increased because of the number of students that come to Bangalore for further education and internships at some of the biggest IT businesses in the world.

One can choose from the numerous neighbourhoods in Bangalore. Be it Electronic City, Panathur, etc. on the southeast side, Hennur, Devanahalli on the north and northeast side or Banashankari on the south.

To find your perfect home in SOBHA, write to us at [email protected]. Explore a wide range of apartments for sale in bangalore and book a site visit with us at 080 4646 4500.

SOBHA Neopolis - Luxury Residential Projects for Sale in Bangalore

SOBHA Neopolis is a luxurious real estate project in India’s thriving East Bangalore region. Developed by the esteemed SOBHA Limited, one of the country’s most respected and renowned developers, this luxury gated community features well-designed living spaces and amenities tailored to meet the demands of contemporary urban living.

This project provides residents with an enriching lifestyle experience, achieved through meticulously designed Greek-themed apartments, luxurious amenities, and sustainable infrastructure in East Bangalore’s Panathur.

Residents can enjoy thoughtfully planned green spaces, community parks, sports facilities, and more within the premises. These amenities are seamlessly integrated into the project, reflecting SOBHA’s commitment to creating extraordinary living experiences. What’s more, shopping arcades, healthcare centres, and educational institutions are in close vicinity of this luxury project.

With the much-anticipated and highly successful launch of SOBHA Neopolis, the company has set new benchmarks in quality construction, architectural innovation, and customer satisfaction within the real estate industry. This apartment complex is a testament to the company’s unwavering dedication to excellence, ensuring that residents enjoy a truly exceptional and fulfilling lifestyle.

Luxury Amenities at SOBHA Neopolis

In today’s fiercely competitive real estate market, luxury apartment amenities are crucial in attracting affluent tenants who seek an opulent lifestyle. Property managers and developers are well aware of the importance of providing unique features that surpass the typical offerings found in apartments for sale in Bangalore.

For individuals yearning for a sophisticated and refined way of living, modern fitness centres, awe-inspiring city vistas, and private parking are no longer mere luxuries but essential requirements. These enticing amenities in apartments offer convenience and symbolise exclusivity & social status. Here is just a glimpse of the opulent features of SOBHA Neopolis:

– State-of-the-art Fitness Facilities: Follow your regime at the meticulously designed fitness centres that have modern equipment and a variety of options within the premises. Whether you prefer cardio workouts, strength training, or group classes, these facilities cater to all your exercise needs.

– Breathtaking City Views: Imagine waking up to panoramic vistas of the city skyline, where every sunrise and sunset paints a mesmerising picture. The project offers stunning views that will leave you in awe and constantly remind you of the beauty surrounding you.

– Exclusive Private Parking: Say goodbye to the hassle of searching for parking spaces or worrying about the safety of your vehicle. This apartment complex boasts of secure and private parking facilities, ensuring your prized possessions are well-protected and easily accessible.

– Recreational Zone: Immerse yourself in a diverse range of interests & pastimes alongside like-minded individuals, thanks to the meticulously curated amenities at the Recreational Zone. Whether you prefer to unwind with a captivating book by the water, savour a delightful meal outdoors, or gather around cosy bonfires on chilly evenings, this zone offers the perfect setting for relaxation and enjoyment.

– Clubhouses: Inspired by the vibrant Santorini Island, 3 grand clubhouses span an impressive 77,850 square feet. They provide a plethora of indoor activities, allowing you to celebrate, socialise, and engage in a wide array of pursuits that are designed for multiple age groups. Whether you seek lively mingling or serene solitude, these lavish clubhouses cater to your every need.

– Park & Plaza: Immerse yourself in the splendour of nature at Park & Plaza – delight in an array of amenities at this Zone, that are designed to bring you closer to the great outdoors. Meander along elaborate pathways, bask in the beauty of lush gardens and cascading water features, and revel in the enchantment of our amphitheatres. Whether you prefer a stroll, wish to partake in festive gatherings, or seek inspiration by gazing up at the sky, this zone offers a serene escape from the ordinary. Additionally, our outdoor workspaces provide the perfect blend of productivity and tranquillity for those who find solace in working amidst nature’s embrace.

– Kids’ Zone: From toddlers to teenagers, the Greek Paradise offers an extensive range of activities tailored to children of all ages. These thoughtfully designed facilities are strategically located in car-free zones, ensuring the utmost safety for your little ones. Let their imaginations run wild as they explore and enjoy various enriching experiences.

– Aqua Park: Witness the sheer delight on your child’s face as they immerse themselves in the wonders of our luxurious water park. Watch as they frolic in the kids’ pool and glide down thrilling water slides.

This is just a glimpse of the well-designed amenities at SOBHA Neopolis, along with the apartments for sale in Bangalore. We understand the importance of creating a living environment that meets and exceeds your expectations. SOBHA’s commitment to providing exceptional features sets it apart in the real estate market, making the company the ideal choice for those seeking a refined and upscale lifestyle. Experience the epitome of luxury at SOBHA Neopolis, where every detail has been carefully crafted to offer you the pinnacle of luxurious living.

Connectivity

East Bangalore has experienced remarkable growth in recent years, positioning it as the perfect destination for individuals, families, and businesses. With its strategic location, East Bangalore offers unparalleled connectivity to key areas of the city. Major roadways such as the Outer Ring Road and the bustling National Highway 44 ensure convenient access to vital business hubs – including ORR, Whitefield, Marathahalli, Sarjapur Road, and Electronic City.

Moreover, East Bangalore is at the forefront of cutting-edge transportation initiatives, such as the planned Peripheral Ring Road and the upcoming Metro lines. These initiatives aim to reduce commuting times and enhance connectivity, benefiting both residents and businesses. This region’s concentration of IT parks, global corporations, esteemed educational & healthcare institutions has been consistently attracting highly qualified professionals – fostering economic growth and all-round development.

Furthermore, East Bangalore offers diverse recreational amenities – ranging from innovative restaurants to state-of-the-art sports complexes, verdant parks, and large retail centres. These amenities cater to individuals seeking a well-rounded lifestyle, ensuring a vibrant and fulfilling living experience.

Considering all these factors, East Bangalore emerges as an attractive investment destination for flat owners. Its advantageous location and exceptional connectivity options make it ideal for those seeking top-notch investment opportunities.

SOBHA Neopolis – Luxury Project Highlights

Inspired by the timeless Grecian elegance, this Greek-themed project stands out for its impeccable design and architecture. From the moment you step through the grand entrance that is adorned with imposing columns, you are transported to a world of sophistication and beauty. Meticulously landscaped gardens create a serene and enchanting atmosphere, reflecting the grace and charm of Greek culture.

Located in Panathur in East Bangalore, these apartments for sale have been thoughtfully designed to provide the utmost comfort and functionality. With spacious interiors and premium fittings, every detail has been carefully curated to enhance your living experience. Each residence is a sanctuary of tranquillity, offering a retreat from the bustling city.

Residents of SOBHA Neopolis are privileged to enjoy a wide range of high-end amenities. The clubhouse, a hub of activity and relaxation, features state-of-the-art gymnasium, refreshing swimming pool, and various sports facilities. Whether you seek an invigorating workout or a leisurely swim, the clubhouse caters to your every need.

In addition to its luxurious offerings, SOBHA Neopolis boasts of excellent connectivity. Located near major roads and transportation hubs, this luxury gated community enjoys easy access to the city’s bustling centres and important destinations. This prime location ensures you are always well-connected, making your daily commute a breeze.

SOBHA Neopolis is more than just a residential project; it is a gateway to a world of luxury and elegance. Here, you can immerse yourself in the charm of ancient Greece while enjoying all the modern comforts and conveniences. Indulge in a truly luxurious living experience that combines the best of both worlds.

This luxury residential project in East Bangalore has distinguished itself through its unwavering commitment to sustainability, with a range of innovative features that make it eco-friendly and energy-efficient. One notable aspect is the design of the buildings, which feature large windows that allow for abundant natural lighting. This thoughtful design reduces the need for artificial lighting during the day, resulting in significant energy savings.

Moreover, the apartment complex employs rainwater harvesting techniques to conserve water resources. This system serves various purposes such as gardening or recharging groundwater levels. This sustainable approach ensures that water is utilised efficiently, minimising waste and promoting responsible water usage.

In addition to these measures, SOBHA Neopolis harnesses solar panels to generate renewable energy. By doing so, the project significantly reduces carbon emissions and lessens its dependence on conventional power sources. This forward-thinking approach benefits the environment and contributes to a greener and more sustainable future.

Furthermore, the project boasts of extensive green spaces and beautifully landscaped gardens. These elements enhance the aesthetic appeal of the development and create a vibrant environment that promotes biodiversity. The presence of greenery contributes to the overall well-being of residents, providing a serene and refreshing atmosphere.

Meticulous attention to detail and long-term environmental responsibility in the real estate industry are evident in the sustainability features of SOBHA Neopolis. Located in East Bangalore, this project sets a new standard for eco-friendly living, demonstrating that it is possible to create a harmonious balance between modern living and environmental consciousness.

Floor Plans and Unit Options

SOBHA Neopolis presents an exquisite range of 3 and 4-bedroom apartments for sale – boasting of spacious dimensions ranging from 2150 to 2481 square feet. The pricing of each flat is determined by its size, ensuring a diverse range of options to suit individual preferences and requirements. The units and their dimensions are listed below.

Unit Type SBA (sq ft)

4 BHK 2333-2481

3 BHK + Study 2150-2178

3 BHK 1611-1915

1 BHK 660

Investment, Financing, and Buying Process

Contact us to receive clear and transparent communication that will aid you in making an informed decision regarding your future home.

At SOBHA, we take great pride in delivering exceptional customer service, and strive to establish long-term relationships with our valued customers. You can download the project brochure from the SOBHA Neopolis webpage. Visit SOBHA Neopolis Experience Centre to understand the offering in detail. Once you have chosen the desired flat, one of our representatives will promptly discuss the associated costs.

We understand the significance of this decision and are committed to providing you with the necessary information & support throughout the process. Our dedicated team is here to address any queries or concerns you may have – ensuring that your journey towards your dream home is smooth & hassle-free.

Feel free to reach out to us anytime, at 08046464500 or [email protected], and we will be more than happy to assist you.

Conclusion

SOBHA Neopolis is a luxury residential project inspired by Greek architecture, situated in the prime location of Panathur. This exceptional development offers a truly remarkable living experience to its residents. Spread over an expansive area of 25 acres, it boasts of 19 meticulously designed towers, each housing well-appointed apartments for sale. The architectural design of this project exudes modern aesthetics, seamlessly blending contemporary elements with timeless Greek influences.

At SOBHA Neopolis, residents are treated to many state-of-the-art amenities that enhance their quality of life. Three Santorini-inspired clubhouses provide a luxurious space for socialising and relaxation. Lush, landscaped gardens create a serene environment, while jogging tracks offer the perfect setting for fitness enthusiasts. Sparkling swimming pools, well-equipped gymnasium, and dedicated children’s play area cater to the diverse needs of residents – ensuring a holistic living experience.

Convenience is a key aspect of SOBHA Neopolis, as it is strategically located near renowned schools, hospitals, shopping malls, and IT parks. This ensures that residents have easy access to all essential amenities and services, making their daily lives hassle-free and enjoyable. Moreover, the project emphasises sustainability, incorporating eco-friendly features such as rainwater harvesting systems and solar panels. By embracing these pro-nature practices, SOBHA Neopolis contributes to a greener future.

With its unwavering commitment to superior construction quality and a focus on providing a luxurious lifestyle within a sustainable environment, SOBHA Neopolis stands as the epitome of excellence. It is the ideal choice for discerning homebuyers who seek a Mediterranean way of life in the vibrant city of Bangalore.

Why it is Worth Investing in SOBHA Flats In Bangalore?

The real estate market in Bangalore – often called the Silicon Valley of India, has thrived due to its status as a significant IT hub in the country. The demand for flats in Bangalore has been fuelled by numerous IT companies, ongoing infrastructure developments, and the city’s appeal as a destination for educational and cultural activities. The startup ecosystem has also played a significant role in driving the demand for office spaces and contributing to the overall growth of the real estate sector.

Established in 1995 by PNC Menon, SOBHA Limited is a reputable real estate developer in India. While headquartered in Bangalore, the company has expanded its operations to various cities nationwide, highlighting a diverse portfolio that includes residential, commercial, and contractual projects. Known for its commitment to quality and adherence to international standards, SOBHA Limited has received numerous awards and recognition for its contributions to the real estate sector.

Navigating the dynamic real estate landscape in Bangalore requires a meticulous comparative analysis, especially when considering whether to invest in a property or not. It becomes evident that several vital factors set SOBHA Limited apart in the competitive real estate market in Bangalore.

SOBHA’s Reputation and Track Record

SOBHA Limited has established robust reputation in the real estate industry, underscored by its unwavering commitment to quality construction and innovation. Renowned for using high-grade materials and strict adherence to international construction standards, the company has consistently delivered properties that have set benchmarks for excellence.

The brand’s track record is marked by a diverse portfolio that spans residential, commercial, and contractual projects. This versatility highlights the company’s ability to cater to different real estate market segments. With a strong presence in multiple cities across India, SOBHA has demonstrated its strong adaptability to diverse market conditions – contributing to its success on a national scale.

The company’s numerous awards and accolades – recognising achievements in construction quality, project planning, and corporate governance – affirm its status as one of the leading and highly regarded real estate developers in India. When homebuyers decide to invest in an apartment in Bangalore, no wonder SOBHA tops the list.

Quality of Construction and Design

SOBHA Limited is widely recognised for its unwavering commitment to the quality of construction and innovative design in its real estate projects. The company emphasises using high-quality materials and adhering to stringent construction standards, ensuring that its properties meet international benchmarks for excellence.

When it comes to design, SOBHA apartments in Bangalore are acknowledged for their innovative and thoughtful architectural approach. The company integrates modern design elements into its projects, creating aesthetically pleasing and functional spaces. Whether in residential or commercial developments, the company’s focus on design extends beyond aesthetics to consider practicality and the evolving needs of its occupants.

Prime Locations of SOBHA Flats

SOBHA Limited strategically chooses prime locations for its residential and commercial developments, with a significant presence in cities such as Bangalore, Pune, Chennai, Thrissur, GIFT City Gujarat, and more. These locations are selected based on robust growth potential, convenient access to essential amenities, homebuyers’ proclivity to invest, and proximity to critical infrastructure.

SOBHA’s commitment to providing quality living and working spaces is evident in its apartments in Bangalore in prominent neighbourhoods like Panathur and Bellandur, Kothrud in Pune, Porur in Chennai, and other sought-after areas. The company’s expansion to various cities reflects its focus on meeting residents’ and businesses’ diverse real estate needs across India.

Amenities and Facilities

SOBHA Limited is recognised for its commitment to enhancing its developments’ living and working experiences by offering diverse high-quality amenities and facilities, making it worthwhile for those who invest in flats in Bangalore. Standard features across SOBHA flats for sale in Bangalore include meticulously landscaped gardens, well-equipped clubhouses, swimming pools, sports facilities, fitness centres, and dedicated children’s play areas.

The company prioritises security with advanced surveillance systems and gated communities. Additionally, community spaces, retail areas, and business centres may be integrated into specific developments, catering to the diverse needs of residents and businesses. Thoughtful inclusion of amenities in apartments in Bangalore reflects the company’s dedication to creating holistic and well-rounded environments that contribute to a luxurious and comfortable lifestyle for occupants.

Pricing and Financing Options

SOBHA Limited typically offers a range of pricing options to accommodate various budget considerations across its diverse portfolio of residential and commercial projects. The pricing of properties can vary based on factors such as location, project type, unit size, and the amenities offered. The company is known for delivering high-quality projects, and as a result, the pricing structure often reflects the premium nature of its luxury apartments for sale in Bangalore.

For financing options, SOBHA developments are eligible for home loans from leading financial institutions. Prospective buyers who want to invest in flats in Bangalore can explore mortgage options from banks and housing finance companies. Availability of financing may depend on factors such as the buyer’s creditworthiness, income, and the specific lending policies of the financial institution.

Security Features

SOBHA Limited strongly emphasises ensuring residents’ safety within its developments through a comprehensive array of advanced security features. These include gated communities with controlled access points, sophisticated surveillance systems comprising CCTV cameras, and trained security personnel in key areas.

Access control systems, intercoms, and video door phones contribute to secure entry management, while well-lit shared areas, perimeter security measures, and adherence to fire safety standards further enhance overall safety. The company’s commitment to providing a secure living environment in luxury apartments for sale in Bangalore aligns with its dedication to delivering high-quality and holistic real estate solutions – promoting its occupants’ well-being and peace of mind.

Future Growth and Appreciation

Future growth and appreciation potential of SOBHA flats in Bangalore are influenced by strategic factors such as focus on prime locations, commitment to quality construction, and ability to adapt to changing market dynamics. The company’s history of delivering high-quality properties, coupled with its emphasis on customer satisfaction and innovative design, contributes to the appeal of investing in flats in Bangalore.

Factors such as strategic location choices, market conditions, infrastructure development, and adherence to economic trends play pivotal roles in determining the appreciation potential of investing in flats in Bangalore.

Comparison with Competing Projects in Bangalore

A detailed comparative analysis of SOBHA flats with other real estate developments in Bangalore is crucial for potential buyers looking to invest. Several factors can be considered, to assess the brand’s unique selling points and differentiation from competitors:

– Quality of Construction: The company is renowned for its commitment to high-quality construction and attention to detail. Comparing the construction standards, material quality, and finishings of SOBHA flats in Bangalore with those of competing projects can provide insights into the overall durability and value of the properties.

– Location: The location of each real estate development significantly influences its potential for appreciation and impacts the decision to invest. To assess the strategic advantage of location, SOBHA flats for sale can be compared with other projects – in terms of accessibility, proximity to critical infrastructure, and neighbourhood amenities.

– Amenities and Facilities: The range and quality of amenities provided in SOBHA apartments for sale in Bangalore, such as landscaped gardens, clubhouses, and security features, should be compared with those offered by competitors. Unique or superior amenities can be a significant differentiator.

– Track Record and Reputation: The company’s track record in delivering projects on time and maintaining exacting standards has set it apart. Comparing customer reviews, testimonials, and the company’s reputation with those of competing developers provides valuable insights.

– Design and Architecture: The architectural design and layout of SOBHA flats for sale in Bangalore can be compared with competing projects to evaluate the properties’ uniqueness, functionality, and aesthetic appeal.

– Customer Service and After-Sales Support: Assessing the level of customer service and after-sales support provided by them compared to competitors, contributes to residents’ overall satisfaction and long-term experience.

– Sustainable and Green Features: In an era of increasing environmental awareness, comparing SOBHA developments’ sustainability and green features with that of competing projects can play a key role in the eco-friendly buyer’s decision to invest.

– Financing Options: Examining the financing options & payment plans, and collaborating with financial institutions can be a differentiating factor – particularly for buyers looking for flexible and attractive financial arrangements.

By conducting a thorough comparative analysis based on these factors, potential buyers can understand SOBHA’s unique selling points and how its luxury apartments for sale in Bangalore stand out in the competitive real estate market.

Final Thoughts

SOBHA’s unwavering commitment to quality construction emerges as a cornerstone, emphasising their meticulous attention to detail and use of high-grade materials. Coupled with a strong track record of timely project delivery, this commitment underlines the reliability and trustworthiness associated with the developer. The strategic selection of prime locations further solidifies their position.

Comparing the accessibility, proximity to essential infrastructure, and neighbourhood amenities reveals a thoughtful approach that enhances the overall appeal of its developments. Amenities and facilities also play a crucial role in setting SOBHA apart from the competition. The company’s dedication to creating holistic living environments with state-of-the-art amenities displays its commitment to providing a luxury lifestyle.

Moreover, their unique selling points extend to customer-centric practices, green and sustainable features, and collaborative financing options that support the decision to invest. Strong emphasis on customer service, after-sales support, and environmental responsibility adds layers of value to the SOBHA experience.

In pursuing the ideal property, this comparative analysis serves as a compass, guiding potential buyers through the nuances of the real estate market. Whether it is the quality of construction, strategic locations, or well-designed amenities for all age groups, SOBHA Limited distinguishes itself as a developer who blends vision with execution – setting a benchmark for excellence in Bangalore’s thriving real estate sector.

Flats Near IT Hubs in Bangalore for Working Professionals

Undisputedly the Silicon Valley of India, Bangalore is home to thousands of IT and ITeS companies. They include fledgling startups to multinational behemoths. Operating from sprawling tech parks dotted across Bangalore, these organisations mark the city’s presence in the information technology landscape of the world.

SOBHA – the Real Estate Icon of Bangalore

SOBHA, started in the year 1995 in Bangalore, is one of the most revered real estate brands in the country. Widely known for its unmatched quality standards, SOBHA’s rapid expansion over the years to other regions in the country is a testimony to its unwavering commitment to excellence.

Today, SOBHA is present in 27 cities in 14 states. In just over 27 years, It has delivered more than 150 residential projects, 332 contract projects, and 19 commercial projects.

It holds the reputation for being India’s first self-reliant real estate company. German engineering and the backward integration model it diligently follows are the distinguishing factors that help SOBHA maintain its famed quality standards and deliver each project on time, every time.

Each of its project undergoes 1,456 quality checks before it is handed over to the homebuyers. In short, It leaves nothing to chance in its constant endeavour to provide unsurpassable quality.

The IT Hubs of Bangalore

Being the Silicon Valley of India, Bangalore has plenty of jobs to offer for IT professionals. As a result, people from all over the country flock to Bangalore. Most of these professionals work in the major IT hubs of Bangalore, such as Electronic City, the Outer Ring Road, particularly Bellandur and Sarjapur, and Manyata Tech Park.

The Advantages of Living Close to Your Workplace

Bangalore is known for its vibrant culture, pleasant weather, and great social life. All these together contribute to the city’s livability factor. However, traffic in Bangalore can be tiresome, especially during peak hours. Hence, the closer you live to your workplace, the better.

SOBHA’s Emphasis on Location

Each SOBHA home is meticulously crafted to ensure that it lasts for generations. The same importance that is given to the quality of construction is also given to the location of the property. Hence, the location of each project is finalised after intensely studying a variety of factors, which include feasibility, connectivity, livability index, etc.

SOBHA’s Flats in Bangalore for IT Professionals

Let’s now take a look at SOBHA flats, which are available near the IT hubs of Bangalore. These flats are located in Electronic City, Outer Ring Road, and Off Thanisandra Main Road in North Bangalore.

SOBHA Townpark

Bangalore’s first-ever New York-themed integrated township, SOBHA Townpark is located near Electronic City. Featuring two residential towers, namely Manhattan Towers and Brooklyn Towers in configurations of 3 & 4 BHK, these apartments offer world-class amenities and an unmatched lifestyle.

The indulgences offered at Manhattan Towers include the kids’ play area, skating rink, bio-pond, Fountain Plaza, stepped seating, senior citizens’ park, clubhouse, multi court, cricket pitch, swimming pool and kids’ pool, badminton court, coworking space, multipurpose hall, steam and sauna, table tennis, billiards, cards, carroms and chess, foosball, air hockey, gym, yoga and aerobics, and a clinic.

Equally loaded with amenities, Brooklyn Towers features a pet park, futsal court, cricket pitch, half basketball court, volleyball court, clubhouse, Sunset Walk, camping lawn, leisure pool, Arbor Walk, Rainbow Step Play, badminton court, Bamboo Trek, Work Canopy, Sunset Promenade, Skate-robics, eco pond, reflexology walk, senior’s hangout, Woodbridge Events Corner, Brooklyn Bridge (kids’ play area), food truck café and more.

If you are an IT professional working in Electronic City, choosing your home in SOBHA Townpark will help you in multiple ways. Besides enjoying an unparalleled lifestyle, you can ensure commuting will be a breeze. If you are working from home, there are dedicated coworking spaces that will help you stay focused on your work without distractions. The metro line that is being extended to Hosur will also provide seamless connectivity.

SOBHA Royal Crest

Crafted in the architectural footsteps of the iconic Bangalore Palace, SOBHA Royal Crest is strategically located in Banashankari. With great connectivity to Electronic City, these 3&4 BHK opulent abodes are an ideal choice for IT professionals.

In terms of amenities, SOBHA Royal Crest has no dearth. The key amenities include a well-equipped clubhouse, amphitheatre, party lawn, swimming pool, kids’ pool, playground, pet park, jogging path, and organic garden.

Electronic City is easily accessible from Banashankari. Connectivity will see dramatic improvement once the metro network, which is rapidly progressing, becomes operational. As a result, for IT professionals who work in Electronic City, SOBHA Royal Crest will offer all that they desire for – connectivity, luxury lifestyle and a great neighbourhood.

SOBHA Insignia

Bespoke homes that brilliantly blend luxury and technology, SOBHA Insignia features ultramodern amenities and expansive spaces. Equally alluring is its location, right in the IT corridor of Bangalore, in Bhoganahalli. Available in configurations of 3, 3.5 & 4 BHK, these limited-edition homes offer smart luxury and seamless connectivity, particularly to the Outer Ring Road, Bellandur, and Sarjapur – areas that house sprawling tech parks such as Ecospace, Ecoworld, etc.

Top-notch amenities at SOBHA Insignia include a swimming pool, well-equipped gym, multipurpose hall, toddlers’ sand lot, jogging path, reflexology path and more.

For professionals who work in the IT corridor, SOBHA Insignia would be a perfect choice as many tech parks are just a hop, skip and a jump away from its location. It also has exceptional connectivity to all parts of Bangalore.

SOBHA Dream Gardens

Inspired by the principles of Zen, SOBHA Dream Gardens is a one-of-a-kind residential project off Thanisandra Main Road. Located near one of the most prominent IT hubs of Bangalore, these 2 BHK apartments offer thoughtfully designed amenities that will help you enjoy a tranquil lifestyle.

The key amenities at SOBHA Dream Gardens include the Koi Pond, Bamboo Walk, Zen Gardens, Reflexology Gardens, meditation decks, Torii gate, swimming pool, clubhouse, and Seniors Avenue.

For those who work in Manyata Tech Park or nearby areas, SOBHA Dream Gardens would be a perfect choice. With zero commuting worries and more quality time at their disposal, life will be more joyous and rewarding. For professionals working from home, the carefully designed outdoors that exude the spirit of Zen would be the perfect place to increase their productivity.

SOBHA Apartments – Unique Features

Each apartment by SOBHA is known for its stupendous quality standards. In addition to these, there are various factors that make SOBHA homes unique. Let’s take a look at the most important ones among them.

SOBHA is one of the pioneers of themed architecture, Hence, you get homes inspired by cities, architectural marvels, and more. For instance, the apartments featured above are inspired by New York, Bangalore Palace, the philosophy of Zen, etc.

When it comes to amenities, each SOBHA home has an exciting range of them. Meticulously planned, each of these amenities caters to the needs of residents of all ages – from toddlers to senior citizens. What is more, there are even pet parks in SOBHA’s apartments.

Covid-19 has changed the way people work forever as work from office has made way for the work-from- home / hybrid models for a lot of sectors. SOBHA, with its penchant for embracing change, was one of the first developers to offer dedicated coworking spaces and home offices in apartment complexes.

SOBHA seamlessly integrates luxury and technology and offers features such as home automation, sensors for common area lighting, etc. These features help residents to enhance the quality of their life.

One of the key benefits of living in an apartment is the safety and security it provides. Each SOBHA apartment offers foolproof security measures on the premises. With experienced security professionals monitoring the area and 24×7 CCTV surveillance, the safety and security of a resident will never be a concern within a SOBHA apartment complex.

Green Spaces and Sustainability

SOBHA keeps sustainability at its core. Hence, each SOBHA apartment complex has an abundance of features that promote green living. Besides, SOBHA plants a wide variety of shrubs and trees in each of their projects to create an ideal microclimate on the premises throughout the year.

Sustainable practices in SOBHA apartments include rainwater harvesting, water recycling, solar panels, sensors for common area lighting, etc. All these measures ensure that precious resources are used judiciously, and wastage is minimal.

Connectivity and Transportation

SOBHA conducts extensive research before finalising the locality for any of its residential projects. Quite naturally, each of its apartment will have the benefit of seamless connectivity and accessibility to public transportation and major roadways, proximity to hospitals, educational institutions, shopping centres, etc. All these ensure that life in a SOBHA apartment is convenient and hassle free.

SOBHA Apartments – Pricing and Finance

The above-mentioned SOBHA apartments are in the range of Rs. 86 lakh to Rs. 2 crore and upwards. SOBHA’s reputation as one of the finest builders in the country as well its flawless track record ensures that getting a loan to purchase a SOBHA home would be hassle free, provided that the buyer’s credit score and financial track record are healthy.

Investing in a SOBHA home will yield great returns. Factors that contribute to the tremendous appreciation of a SOBHA apartments are as follows:

SOBHA’s reputation as one of the finest builders in the country.

The strategic areas where SOBHA apartments are located.

The increasing demand and subsequent growth of real estate in Bangalore.

SOBHA – India’s First Self-reliant Real Estate Company

As already mentioned above, SOBHA enjoys tremendous reputation among homebuyers and corporate honchos alike, thanks to its iconic residential and commercial edifices. Over the years, SOBHA has created homes across India – most of them were sold out in record time. It has also crafted iconic landmarks for renowned organisations such as Dell, Biocon, ITC, Bosch, Infosys, Lulu and more.

As India’s first self-reliant real estate company, SOBHA introduced the concept of backward integration in the real estate sector. With sprawling manufacturing units of its own, SOBHA has absolute control over quality. The precast construction methodologies help SOBHA to reduce the environmental impact and deliver the projects on time, every time.

Over the years, SOBHA has garnered innumerable awards and accolades from reputed industry bodies for its unmatched quality standards. As a household name for quality homes, It is growing at a phenomenal pace.

Contact SOBHA Ltd.

If you are an IT professional planning to purchase a home, choosing a SOBHA apartment near an IT hub in Bangalore will be advantageous to you. All you need to do is to call 080 46464500. You can explore further at www.sobha.com or write to [email protected].

Luxury Living in Bangalore: A Handy Guide to High-end Residential Projects in the City

For many an aspirant, Bangalore is a dream destination. For decades, the city has been receiving people from all over the country, thanks to its eternal charm. Over the years, the city’s reputation as a pensioners’ paradise has made way for ‘India’s IT capital.’ Still, that one moniker the city is most famous for, the ‘garden city’, remains intact, so is its salubrious climate. As Bangalore is growing at an exponential rate, there emerges a new affluent class who prefer to live their life in the lap of luxury.

Luxury Living – an Ever-evolving Concept

Luxury is constantly evolving. All the more so when it comes to luxury homes. However, there are certain parameters that would make a home a luxury home. First among these are the amenities – the more, the better. Ideally, a luxury home should have clubhouses, swimming pools, open areas, children’s play area, multiple avenues for leisure, etc. In addition to amenities, leveraging technology for comfort and convenience is another attribute of a luxury residence. For example, smart homes / automated homes are a preferred choice for those who seek luxury living. Finally, in a city like Bangalore where traffic is a concern for many, a home that is well-connected and is close to office spaces, schools, hospitals, and other conveniences is indeed a luxury.

Growing demand for luxury residential projects in Bangalore

Ever since the IT boom started, Bangalore has acquired a special place in the global information technology horizon. Soon, organisations of international repute started setting up their offices in sprawling IT parks in Bangalore, providing lucrative jobs to hundreds of thousands of people. These well-paying jobs have been creating a new breed of men and women with disposable incomes and immense purchase power. As a result, over the years, Bangalore has been witnessing a steady demand for luxury residential projects.

Yet another factor that propels the growth of high-end residential projects in Bangalore is the constant demand from NRIs. Among the cities in India, Bangalore sees the most demand for luxury homes from NRIs, followed by Pune, reports property consultant, ANAROCK. Both RERA and GST have a significant role to play in this change. While the former has made buying a home easier and more transparent, GST offers immense financial benefits to customers. Earlier, homebuyers had to pay a bouquet of charges such as service tax, value-added tax, etc. Currently, all these have been subsumed under GST. What’s more, for under-construction homes that don’t come under ‘affordable housing’, GST rate is 5%. Before the implementation of GST, it was 12%.

Factors Influencing Luxury Living in Bangalore

While we have touched upon a few factors that contribute to a home’s luxury quotient, let’s delve deeper now and analyse each attribute of a luxury home in Bangalore.

Location and Proximity to Key Amenities

In a city like Bangalore, where millions of commuters hit the road on every single day, commuting can be a dampener. Hence, choosing a location close to workplaces, educational institutions, healthcare facilities, and other conveniences would ensure that you don’t spend quality time in traffic.

Architectural Design and Innovative Features

As we have already mentioned, the concept of luxury homes is constantly evolving. Homes with innovative architecture and themes are high in demand. SOBHA – one of the pioneers in themed architecture – creates homes inspired by architectural styles, eras, and other distinguished characteristics. Thus, SOBHA’s residential portfolio includes homes crafted in the architectural footsteps of Bangalore Palace, New York, the Spanish town of Galera, and more.

Quality of Construction and Materials Used

A customer pays more for a luxury home. Obviously, they have every right to know about the quality of construction and materials used and ensure that they are of the highest quality. SOBHA – a name synonymous with quality construction uses precast technology – a unique way of constructing homes in a controlled environment, ensuring impeccable quality, matchless precision, and ahead-of-time delivery. The meticulously crafted structure of your home has been built to protect your home from earthquakes, can withstand fire and guard against corrosion.

Security and Privacy Considerations

A home is where you feel the most secured. Privacy is a key characteristic of a luxury home. Modern luxury homes by SOBHA feature sure-fire methods to make sure that your home meets superior security standards. From round-the-clock CCTV surveillance to cutting-edge facilities that prevent any violations, security is of prime importance. When it comes to privacy, SOBHA goes the extra mile to deliver homes that do not have common walls, balconies facing each other, etc.

Availability of High-end Facilities and Services

A luxury home will feature an array of high-end facilities, services as well as amenities. The purpose of these is to make the residents’ lives easier, provide them with options to unwind and contribute to the overall quality of life. A high-end luxury home will have dedicated facilities for leisure – a clubhouse, for instance, sports facilities, multiple swimming pools for both adults and children, pet parks, convenient stores, open spaces, concierge services and more. When you choose to live in a luxury home by SOBHA, you can expect all these and more.

Sustainability and Eco-friendly Features

The world over, there is an increasing awareness about sustainable practices. Conscious individuals choose to live in homes that are made sustainably and where eco-friendly methods are followed every day to preserve water, save energy and more. The advanced precast construction methodologies designed and developed by SOBHA keep sustainability at the core. The advantages include reduced consumption of energy, water, and building materials. In addition to these, SOBHA’s luxury residential projects in Bangalore have won many an award and accolade for the ways in which they preserve natural resources by recycling water and harnessing the power of the sun.

Overview of High-end Residential Projects in Bangalore

With close to three decades of developing high-end residential projects in Bangalore as well as other cities across India, SOBHA has raised the bar in the segment. Besides SOBHA, other A-Grade developers have also been developing luxury residential projects in Bangalore for years.

Currently, for those who seek to buy a luxury residence in Bangalore, options are aplenty in the forms of apartments, penthouses, villas, and row houses.

When it comes to luxury residential apartments, some of the most prominent locations are Koramangala, Indiranagar, HSR Layout, Bellandur, Hennur, Banashankari, Sarjapur Road, etc. Hosur Road, especially areas near Electronic City, are also turning into a residential hotspot.

For villas and row houses, Devanahalli is considered as an ideal location as a lot of residential projects are coming up in the locality. Other locations for these kind of luxury residential projects in Bangalore include Whitefield, Yelahanka, Jakkur, J P Nagar, Sarjapur Road, etc.

Property prices are steadily on the rise in Bangalore. For luxury apartments in Bangalore, the price starts from Rs. 1.5 crore and goes up to Rs. 12 crore and beyond. For luxury row houses and villas, ideally the price starts from Rs. 3 core and goes upward, depending on the facilities, amenities, and other such factors.

Features and Amenities of Luxury Apartments in Bangalore

What really differentiates a luxury residence from an affordable one? Quite a few things. Let’s take a look at some of the most important ones among them.

Opulent Interiors and Premium Finishes

Double-height living room, extensive balconies that offer panoramic views, premium fittings in bathrooms, and superior finish are some of the features that are typical to a luxury flat.

State-of-the-Art Technology Integration

Motion sensors in the lobby, solar power to light common areas, smart home automation… a few things that are found in a luxury home.

Recreational Facilities

A residential community of luxury residences offer a plethora of recreational facilities for the residents such as swimming pool, gyms, spas, clubhouses, sporting facilities and so on.

Thoughtful Outdoor Areas

A luxury residence gives prominence to the outdoors as well, and hence offers a range of meticulously crafted open areas such as landscaped gardens, well-crafted terraces and spacious balconies.

Dedicated Concierge and Personalised Services

When you are hard-pressed for time, finding someone to run an errand for you would be quite a task, but not when the luxury community you live in has dedicated concierge/personalised services.

High-end Dining and Entertainment Options

Some of the high-end luxury residential communities offer top-notch dining and entertainment options for residents.

High-end Luxury Residential Projects in Bangalore

SOBHA, India’s preeminent real estate developer with a proven track record and a massive presence across the country, offers high-end luxury residential projects in Bangalore.

SOBHA Royal Crest

Inspired by the magnificent Bangalore Palace, one of Bangalore’s most iconic landmarks, SOBHA Royal Crest is a tribute to the rich heritage of Bangalore – an emotion that resonates with the times past, a place that also keeps pace with the future. Located in Banashankari, one of the most preferred residential destinations in South Bangalore, these luxury apartments adopt key elements from Tudor-style architecture.

Thoughtfully designed and rich in amenities, nearly 80% of the community space in SOBHA Royal Crest is traffic free. In terms of amenities, these palatial homes offer Topiary Garden, Seniors’ Gazebo, Reflexology Park, Sunrise Walkway, kids’ pool, playground, and a lot more.

SOBHA Royal Crest apartments are well-connected to the Outer Ring Road, NICE Road, Mysore Road, and Kanakapura Road. The locality is accessible to most parts of the city via public transport, including Namma Metro. The project is also close to popular retail centres such as Jayanagar and JP Nagar. The 10-lane-Bangalore-Mysore Expressway is about 5 minutes away from the project. The upcoming phase-2 metro line will make commuting faster, notably travelling to the Bengaluru International Airport. Further, it will connect several markets from north to south in a single corridor. The proposed Bengaluru Suburban Rail Project will facilitate seamless integration between Metro, Rail and Transit & Traffic Management Centres located at BMTC’s transit infrastructure sites such as Banashankari, Vijayanagar, Yeshwanthpur, Peenya, etc.

SOBHA Oakshire

Inspired by Modern Tudor architecture, SOBHA Oakshire offers 4 BHK luxury row houses off Bellary Road, Devanahalli, North Bangalore. Crafted for the discerning few and located at Bangalore’s upmarket residential locale, SOBHA Oakshire brings to the fore the quintessential charm of homes that dot the English countryside and features gabled steep roofs, timber & brick work, and ornate windows.

Welcoming you to SOBHA Oakshire is a grand bell-mouthed entrance. When it comes to amenities, these luxury row houses offer Oxygen Park, kids’ play area, Work Pods, Tranquil Lawns, Reflexology Park, and a private garden.

Devanahalli – a hub of bustling activities, yet a charming neighbourhood with clean air and green environs. With immense connectivity to other prominent areas of the city via NH 44 and the signal-free corridor from Hebbal to the Kempegowda International Airport, the locality ensures that day-to-day commuting would be a breeze. Its proximity to reputed educational institutions, hospitals, malls, major IT parks, and Industrial areas of North Bengaluru makes Devanahalli an ideal location.

SOBHA Galera

Inspired by Spanish architecture and the beautiful town of Galera, SOBHA Galera, set amidst nature, is crafted to offer you an extravagant lifestyle. These Spanish-style luxury row houses feature red-tiled roofs, expansive courtyards, long cobbled streets, and arched entrances and ornamental iron grills in windows and balconies. These homes are an ideal choice for those who prefer a luxury row house over an apartment.

As you enter, you can’t help casting admiring glances at the Majestic Entrance Plaza with a grand archway and cobblestone pavers. The amenities at these beautifully crafted community include a 165-metre Leisure Trail, Corner Cove, Activity Lawn, kid’s play area, pergolas, and the Fountain Belleza – an ornate Spanish fountain.

Located on Whitefield-Hoskote Road near Kannamangala, SOBHA Galera is in close proximity to the upcoming Peripheral Ring Road and the Satellite Town Ring Road. While it is perfectly tucked away from the commotion of the city, it is well-connected to Bengaluru’s reputed social infrastructure. It is this fact that has made the area one of the most preferred destinations for row houses and villa developments in the last 15 years.

Factors to Consider When Choosing a Luxury Property in Bangalore

Let us now look at a few points that are worth considering while choosing your luxury home in Bangalore.

– Budget and Financing Options

Sticking to a budget that is suitable for you is important as well as analysing your financing options.

– Lifestyle Preferences and Needs

Carefully consider your lifestyle requirements before finalising a particular project.

– Investment Potential and Resale value

Always weigh the potential of the property for appreciation as well as its resale value.

– Reputation of the Developer

You are purchasing a big-ticket home, hence checking the reputation and track record of the developer will help you avoid any potential losses.

– Legal and Regulatory Aspects

Always seek the expertise of a legal professional to check all the approvals, title and sale deeds, etc., to ensure that you don’t get into legal complications later.

Luxury Living in Bangalore – Key Considerations

When you purchase a high-value home, it’s quite natural for you to look forward to experiencing a lifestyle that is way above the ordinary. Here are a few characteristics that make a luxury residential project highly desirable.

Infrastructure and Traffic

High-end luxury projects are often located at strategic locations with better infrastructure and ease of commuting.

Sustainability and Environmental Impact

Growing concern for the environment has made responsible builders practise sustainability and lessen the environmental impact.

Market Trends and Future Prospects

The property market in Bangalore in general and the luxury segment in particular have been registering high year-on-year growth steadily, indicating that the future is bright.

Potential for Growth and Appreciation

A high-value property in Bangalore is likely to yield immense returns, thanks to the rapid growth of the city as well as its popularity among HNIs and NRIs as an ideal city to invest in real estate.

Investing in Luxury Residences in Bangalore

As we have seen, Bangalore is the top real estate investment destination in the country. With an expanding HNI customer base, growing interest from NRIs, and massive infrastructural projects that are underway, it is ideal to invest in a luxury project in Bangalore and enjoy high ROI year on year.

Most Expensive SOBHA Apartments in Bangalore

An Icon of Quality in the Real Estate Sector

The Indian real estate sector has many players – old and new, big and small. Among them, SOBHA Limited enjoys a unique position. As a household name known for its superior quality standards, the company has a towering presence across the nation.

Ever since its inception in 1994, the organisation has been steadily raising the benchmark of quality. As a result, it is the first choice of discerning homebuyers who are uncompromising in their approach towards quality.

Over the years, the real estate giant has crafted over 500 iconic projects in residential and commercial spaces spreading over 120 million sq. ft., by paying minute attention to detail – in systems, processes, and design. With its unwavering commitment to deliver impeccable quality, it performs 1,456 quality checks before handing over each home.

Today, it has a staggering footprint across 27 cities in 14 states. The organisation has more than 10,000 employees and has won 200+ prestigious awards in its journey so far.

A Sneak Peek into the World of Themed Luxury

Besides its impeccable quality standards, what makes the organisation a favourite among the discerning homebuyers is the enchanting and unique lifestyle that distinguishes each of its residential properties from one another. As you read on, you will find that you can choose from four abodes of opulence, which are our most expensive offerings in Bangalore. While the first one offers homes that are inspired by the Bangalore Palace, the second and third are architectural tributes to Manhattan and Brooklyn respectively. The fourth is meant for those who prefer a brilliant blend of luxury and technology – abodes that epitomise refined luxury.

SOBHA’s Expensive Apartments for Sale in Bangalore

Four apartments that cater to the discerning taste of customers from the uber-luxury segments and are available for sale are SOBHA Royal Crest, SOBHA Townpark, SOBHA Brooklyn Towers, and SOBHA Insignia. Let’s get to know each of them in detail.

SOBHA Royal Crest

An architectural marvel crafted in the footsteps of Bangalore Palace, these are one of the most expensive apartments by the company in Bangalore. It features fortified towers, turreted parapets, and a host of ultra-modern amenities!

The key points

Total land area: 6. 33 acres.

The amenities include clubhouse, amphitheatre, party lawn, swimming pool, kids’ pool, Arbor Park, play court, playground, pet park, jogging path, organic garden and much more.

SOBHA Townpark

A sprawling and self-sufficient township, SOBHA Townpark is a slice of New York in Bangalore. As Bangalore’s first New York-themed township, this one-of-a-kind community features two of the most expensive apartments in Bangalore – SOBHA Manhattan Towers and SOBHA Brooklyn Towers.

SOBHA Manhattan Towers

Inspired by the most hip and happening borough of New York, Manhattan, these residences offer a unique lifestyle.

The 3BHK offerings are in the size range of 1498 sq. ft.

The key points

Total land area: 7.61 acres

The amenities include Kid’s Play Area, Skating Rink, Bio-Pond, Fountain Plaza, Stepped Seating, Senior Citizen Park, Multi Court, Cricket Pitch, Work From Nature, Swimming Pool, Kid’s Pool, Board Walk, Badminton Court, Co-Working Space, Multipurpose Hall, Steam And Sauna, Table Tennis, Billiards, Cards, Carroms and Chess, Foos Ball, Air Hockey, Gym, Yoga and Aerobics, Clinic, Association Room.

SOBHA Brooklyn Towers

Situated in Bangalore’s first-ever New York-themed self-sufficient residential township, these residences are inspired by Brooklyn, New York’s most scintillating and ever-trending borough.

The 4 BHK apartments are in the size range of 2402 sq. ft.

The key points

Total land area: 8.62 acres.

The amenities include pet park, scenic drive, futsal court, cricket pitch, half basketball court, volleyball court, Prospect Club – the clubhouse, Sunset Walk, camping lawn, leisure pool, Arbor Walk, Rainbow Step Play, badminton court, Bamboo Trek, Work Canopy, Sunset Promenade, Skate-robics, Eco Pond, reflexology walk, Senior’s Hangout, Woodbridge Events Corner, Brooklyn Bridge (Kids’ Play Area), Food Truck Café and more.

SOBHA Insignia

Bespoke homes that brilliantly blend luxury and technology, these apartments feature uncommon luxuries, ultramodern amenities, and expansive spaces.

The project offers 3, 3.5 and 4 BHK configurations in the size ranges of 1819 sq. ft. to 3406 sq. ft.

The key points –

Total land area: 1 acre.

The amenities include Signia Pool, gym, multipurpose hall, toddlers’ sand lot, jogging path, and reflexology path.

Why SOBHA Apartment Projects are Expensive?

These apartments are pricey for valid reasons. Let’s examine them, one after the other.

The Prestigious Location

One of the features that make these homes endearing to the customers is its location. Each one is ideally located, offering seamless connectivity.

Let’s start from the first of the most expensive apartments listed above to understand the prominence the company gives to locations. SOBHA Royal Crest, which is inspired by the Bangalore Palace is located behind PES University, Mysore Road, Banashankari – an ideal location, which is immensely well-connected via multiple modes of transportation. These residences are well-connected to the Outer Ring Road, NICE Road, Mysore Road and Kanakapura Road.

SOBHA Townpark, the sprawling township that features SOBHA Manhattan Towers and Brooklyn Towers, is located near Electronic City on Hosur Road. Thanks to its location, these luxury abodes are minutes away from Bangalore’s most prominent tech hub – Electronic City. The industrial hub of Hosur is also easily reachable. With metro connectivity being extended to Hosur, connectivity to the area will be increased further.

SOBHA Insignia is located on GEAR School Road, behind Wells Fargo in Devarabisanahalli, which is in close proximity to the Outer Ring Road, Bangalore’s IT corridor. These limited-edition homes offer seamless connectivity and is close to some of Bangalore’s most prominent tech parks.

Unparalleled Luxury and Amenities

Each of these homes offers luxury and amenities that are uncommon. Be it the grand entrance, the meticulously crafted living spaces, or the handpicked amenities – unparalleled luxury and lifestyle are the hallmarks of these residences.